What We Do

Trustee Guidance & Trust Administration in Colorado

Serving as a Trustee carries significant responsibility. For decades, Denver-area families have turned to Osterman Law for trusted guidance in trust administration. Attorney Lewis A. Osterman assists clients throughout Denver, Highlands Ranch, Centennial, Thornton, and surrounding communities—ensuring wishes are honored, beneficiaries are protected, and the process is as efficient and stress-free as possible.

How We Streamline Your Role as Trustee

Below is a snapshot of the most frequent responsibilities—duties that can feel overwhelming without experienced counsel:

- Collect and protect all trust assets, including real estate, investments, and digital holdings.

- Obtain fair market valuations for property and closely held business interests.

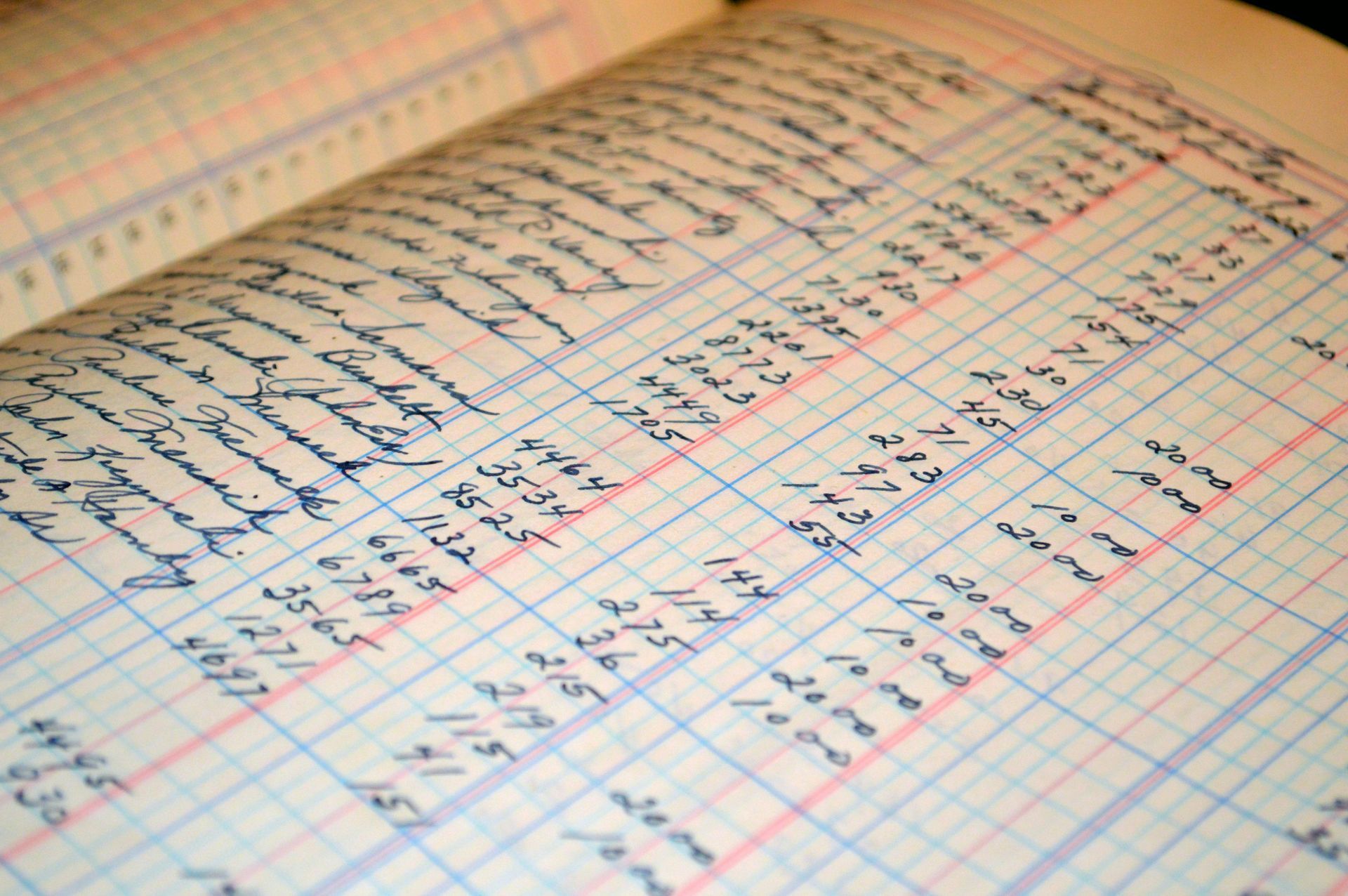

- Keep meticulous records of income, expenses, and creditor claims.

- Prepare and file state and federal fiduciary tax returns while monitoring estimated payments.

- Distribute assets to beneficiaries according to the trust terms, resolving any final debts.

Why Families Choose Our Stewardship

- Seasoned Insight – Forty years in Colorado trust law means you receive precise guidance on deadlines, notices, and how best to administer the trust in a cost-effective and efficient manner.

- Personalized Attention – Each trust is unique; we tailor timelines, communication plans, and fee structures to your situation.

- Unwavering Integrity – Every action meets statutory requirements and ethical standards, shielding you from liability.

Advantages of Partnering with Osterman Law

- Peace of Mind – With advice and guidance from an experienced team throughout the trust administration process, you can focus more on supporting your family and less on navigating the legal system.

- Asset Preservation – Informed guidance helps prevent mismanagement, ensuring assets remain available for the intended beneficiaries.

- Efficient Distributions – We guide trustees through the process of transferring assets to beneficiaries in a timely manner, avoiding the delays associated with probate.

- Clear Communication – We advise trustees on maintaining open communication with beneficiaries to promote understanding and minimize disputes.

- Timely Legal Guidance – We provide prompt advice and assistance on issues that arise during

trust administration, helping trustees make informed decisions and keep the process moving forward.

FAQs

How long does trust administration take?

Many trust administrations can be completed within 6 to 12 months after death; however, it is common for the process to take significantly longer, depending on the circumstances.

Can trustees be paid, and how is that determined?

Yes. In Colorado, trustees are entitled to receive reasonable compensation for their services, with the amount determined by the circumstances of the administration and the nature of the trustee’s responsibilities.

Can beneficiaries challenge trustee compensation and/or administration expenses?

Yes. Beneficiaries may object to trustee compensation or administration expenses they believe are unreasonable based on the circumstances. Our team advises and guides trustees in providing timely, detailed records to keep all parties informed and help reduce the likelihood of disputes.

What taxes may apply?

As a law firm, we do not prepare tax returns. However, tax considerations can arise during trust administration, and our team works closely with qualified tax professionals to ensure that any income or estate tax issues are properly identified and addressed.